Frequently Asked Questions About DAWSON

DAWSON: Case Management

- Can I file a petition to start a new case in DAWSON?

- How do I pay the filing fee?

- Do I need to submit courtesy copies for eFiled documents over 50 pages?

- How are consolidated cases handled in DAWSON?

- How are sealed cases and sealed documents handled in DAWSON?

- Why did I receive an error when I uploaded a file in DAWSON?

- What digital signatures are accepted in DAWSON?

- Yes. Petitions can be filed electronically in DAWSON. For more information, see the User Guides.

- If you file a petition electronically, there is no need to submit an additional paper copy. Likewise, if you have already sent a paper petition to the Court, there is no need to also file a petition electronically.

During the process of electronically filing your petition, a unique Docket Number will be assigned to your case. You may pay the fee on Pay.gov with an accepted payment method (e.g., credit card, bank account (ACH)). Your case Docket Number is required. For more information, see How to Pay the Filing Fee.

No. The requirement for mailed courtesy copies of eFiled documents longer than 50 pages is suspended until further notice.

- Parties to consolidated cases have the ability to electronically file documents simultaneously in all of the consolidated cases.

- Entries of Appearance for petitioner representatives and Decisions must still be filed in each case separately.

- Refer to the DAWSON Release Notes for more information, or the User Guides. for detailed instructions on how to electronically file documents in consolidated cases.

- Sealed Cases

- Parties wishing to file a Petition under seal must file the Petition on paper along with a Motion to Seal. The Motion should specify whether it seeks to seal the entire case or only the Petition.

- Parties wishing to seal a case that is already docketed must file a Motion to Seal.

- With the exception of an initial pleading or entry of appearance, parties may file documents in a sealed case in the same manner as filing documents in a case that is not sealed (including eFiling in DAWSON).

- Sealed Documents

- Specific documents on the docket record can be sealed in two ways.

- A document may be sealed from the public.

- A document may be sealed from the public and from the parties to the case.

- Parties wishing to file a new document under seal must file the document in paper along with a Motion to Seal specifying whether it is to be sealed from the public or the public and the parties.

- Parties wishing to seal a document that has previously been filed (e.g., after discovering missed redactions) may electronically file a Motion to Seal specifying whether it is to be sealed from the public or the public and the parties.

- Specific documents on the docket record can be sealed in two ways.

- For more information, see the User Guides.

-

Error Message: File size too big

- If your document is larger than 250MB, you should upload the information in separate documents. Each document must be 250MB or less.

-

Error Message: The file is corrupt or in an unsupported PDF format

-

There are a few options:

- Resave the file, ensuring that it opens without error in Adobe.

- When saving the file, select "Print to PDF".

- Print the document and use a scanner to create and save a new PDF document.

-

There are a few options:

-

Error Message: Your firewall or network may be preventing submission.

- Try submitting again while on a different network/Wi-Fi. If you have success on a different network, you may need to have your network administrator adjust your network's firewall settings to allow document submissions to https://dawson.ustaxcourt.gov.

-

Error Message: There is a problem with this file

- Your internet browser may be outdated. Please update your browser to the current version and try the upload again.

-

Error Message: The file is encrypted or password protected

- If you signed your document electronically with an application like Adobe, it may have asked you to save the document as a read-only copy that cannot be modified. If you saved your document as a read-only copy, it may have been password protected by Adobe automatically (unbeknownst to you).

- To troubleshoot, review your document(s).

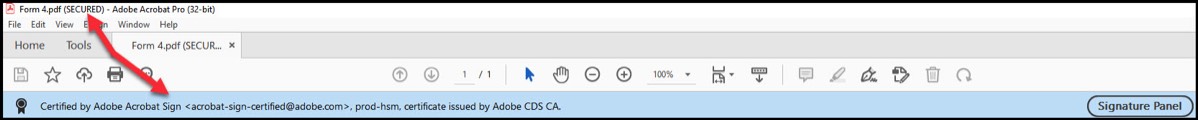

- When viewing your document(s), are you seeing a blue banner and "(SECURED)" at the top of the document?

-

YES - Do ONE of the following steps below to create a new unsecured document file for your submission:

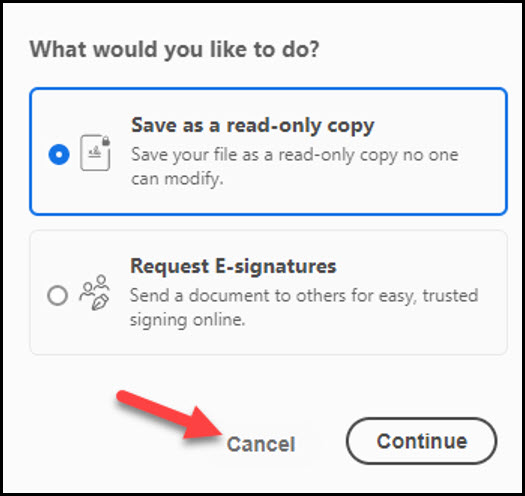

- Create a new document file, and when signing it, decline Adobe's prompt to save a read-only copy by clicking "Cancel" on the screen when prompted. This will prevent Adobe from automatically applying security measures to the file.

- 2. Print the document and scan it back in as a new document file. The new file will not have the security measures applied.

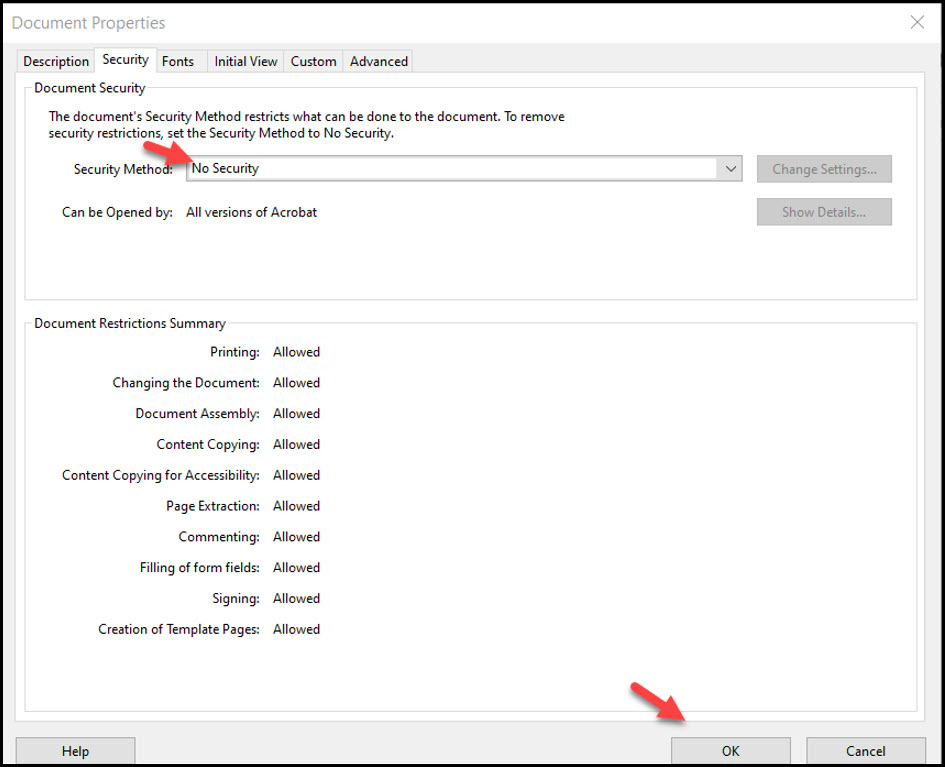

- NO - If you do NOT see the above banner or "(SECURED)" in the document window, follow these steps.

- Right-click in the document.

- Choose Document Properties from the options.

- Click on the Security tab.

- In the dropdown menu labeled Security Method, select "No Security".

- Click OK

- 6. Save the document. You should now be able to upload the document to DAWSON without error.

- Acceptable digital signatures in DAWSON:

- Parties may submit a high-resolution or PDF document bearing either imaged or digitized signatures in satisfaction of the requirements of Rule 23(a)(3), Tax Court Rules of Practice and Procedure.

- PDFs of documents bearing an actual signature are acceptable. (Print and sign before turning into a PDF.)

- Documents signed using an authentication program (e.g., Adobe or DocuSign) are acceptable. Be sure to remove encryption or password protection prior to uploading into DAWSON.

- Stylized signatures (e.g., signing with "/" or using cursive font) are only acceptable when paired with the DAWSON username (email address) and password or with authorization. See Rule 23(a)(3).

- Stylized signatures on paper submitted forms are not acceptable.

- Documents that require a signature in addition to that of the eFiler, e.g., both spouses are petitioners:

- Documents uploaded to DAWSON should be signed by the additional party, using the guidance above, before being uploaded.

- If you chose to auto-generate a Petition in DAWSON and your spouse has authorized you to file an electronic petition, then the signature block on the petition auto-generated by DAWSON will serve as your spouse's signature.